Certified Exit Planning Advisor (CEPA)

- CEPAs align the Business, Financial and Personal goals to the business exit strategy, working alongside the owner and a full resource team.

- They can be business brokers, M&A advisors, wealth managers, CPAs, Estate planners, and value builders.

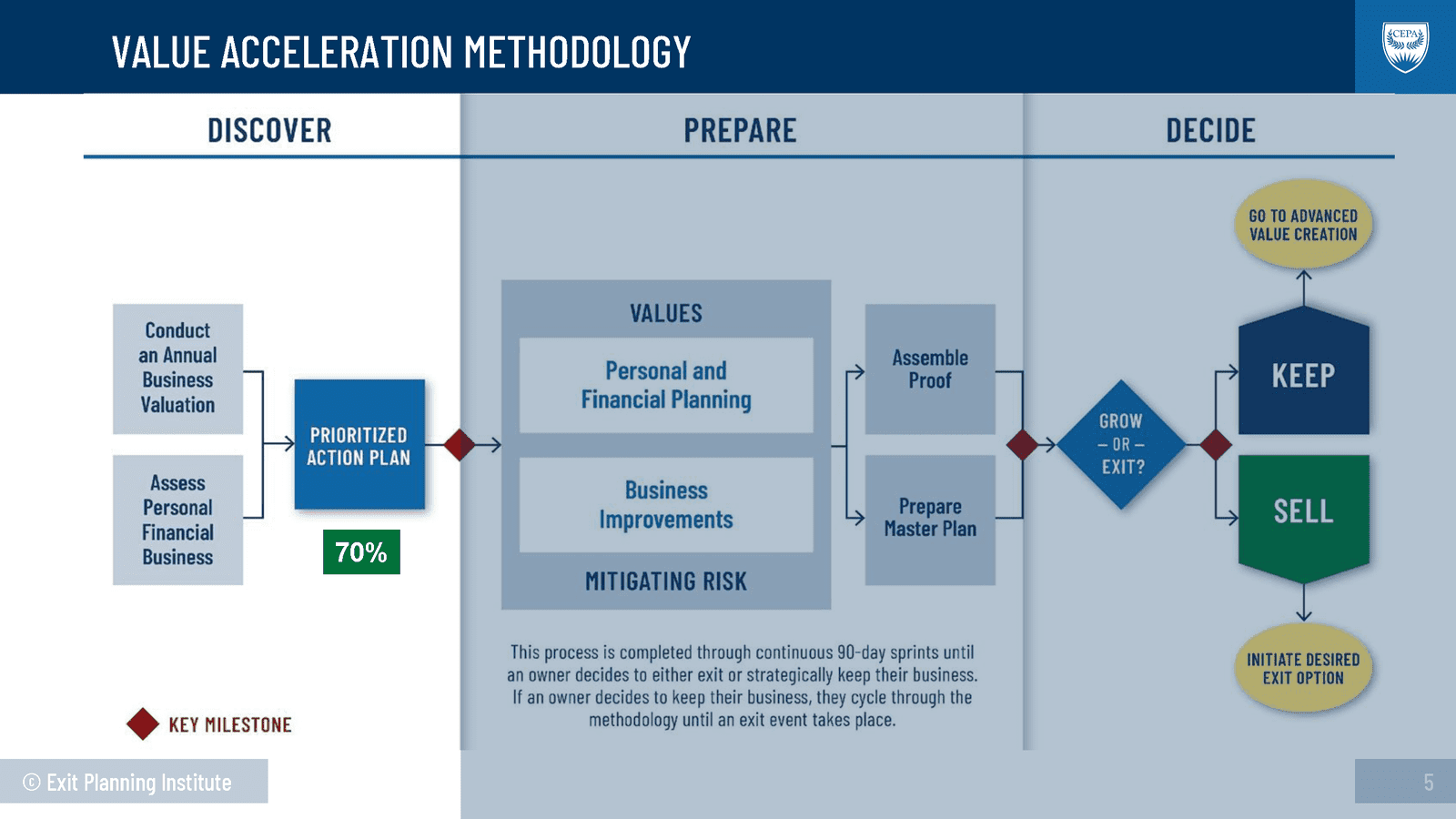

- A CEPA engagement is done in 90-day sprints:

- Discovery, Protection and Decision phases.

90 Day Sprints

After every 90 day sprint, decide whether to continue to grow with the Value Acceleration methodology or Exit the business

Grow:

- Increase Profitability and Net Cash Flow

- Increase Value of Human, Social, Structural, Customer Capital

- Increase alignment of Personal, Financial and Business Goals with the exit strategy identified

- The exit strategy can change as the business grows in value

- Retake assessments at end of each 90 day sprint to note progress towards exit goals

Exit:

- Internal Transfer examples

- Family

- MBO

- ESOP

- External Transfer examples

- Private Equity Group (PEG)

- 3rd party buyer

- Acquisition by a strategic buyer